Introduction

Banks and BFSI institutions have traditionally adopted emerging technologies with deliberate caution. That prudence is essential: banking is the circulatory system of national and global economies. Every payment, loan approval, and risk decision affects markets, directs money flows, and helps keep stability across countless domains. But one misstep can cascade beyond balance sheets - hurting markets, slowing growth, weakening trust, and in the worst cases, even shaking the foundations of the economy.

Agentic AI marks a new era of decision-making systems that go beyond scripted automation to become context-aware and outcome-driven decision makers. Its success has been proven across industries, from self-optimizing supply chains to adaptive customer engagement. For BFSI leaders, the question is no longer whether agentic AI can deliver, but how to safely transition from pilot to production. Thereby, ensuring trust, compliance, and control remain paramount.

Bottom line: The challenge for BFSI is not “if” Agentic AI works, but how to bring it into production responsibly.

Start where you are, scale where you need to be

Not every bank, and in fact, no BFSI institution, is ready to become Agentic-by-Design from day one. This is not a limitation; it is a reality. The journey starts with a clear view of where you are today. Before writing a single line of code or launching a pilot, an honest assessment of your current “as-is” state is essential.

The four readiness questions

- Data Integrity: Is your data clean, unified, and accessible in real time, or are you still wrestling with siloed, outdated feeds?

- System Flexibility: Are your core systems and customer channels API-ready and modular, or tethered to rigid legacy architectures?

- Delivery Muscle: Do you have empowered, cross-functional teams, with business, risk, technology, and compliance all collaborating to co-own agentic AI delivery, instead of leaving it solely to IT?

- Governance Posture: Can your risk and compliance functions actively supervise autonomous agents using policy-as-code, comprehensive audit trails, and escalation triggers?

Taken together, these answers show both whether you’re ready to begin and which starting path makes the most sense.

Matching strategy to maturity

| Current State | Strategic Entry Path | Why It Works |

|---|---|---|

|

Legacy-heavy, Low AI maturity

|

Use Case by Use Case | Focused wins that prove value, mitigate risks, and build trust internally. |

|

Modular, mid-maturity systems

|

Agentic Overlay | Layer autonomy onto existing workflows without expensive re-platforming. |

|

Cloud-native, high maturity ops

|

Agentic-by-Design | Reimagine workflows around autonomous agents, unlocking compounding value at scale |

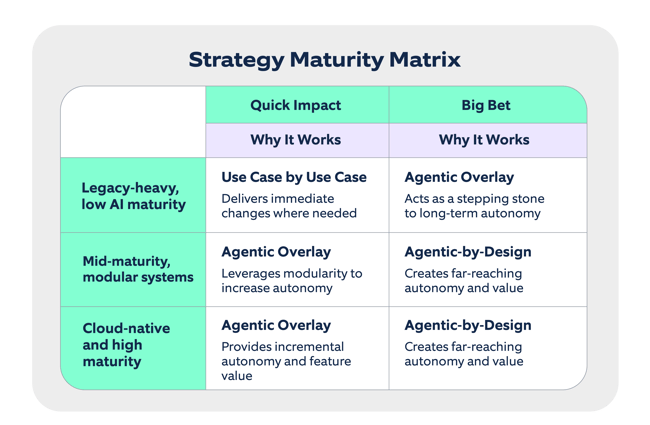

In practice, maturity defines the safest and most effective entry path. The matrix in Figure 1 illustrates how readiness levels align with adoption strategies.

Figure 1: Strategy Maturity Matrix — Aligning current state with the right entry path.

This sequenced approach helps BFSI institutions avoid two common pitfalls: “proof-of-concept theatre” that never truly scales, and “big-bang reinvention” that fails to gain traction.

Pilots as launchpads, not destinations

Use-case pilots offer tremendous value but only when treated as launchpads, not as endpoints. Their purpose is to:

- Demonstrate that agentic AI can deliver measurable ROI in live environments.

- Prove that governance and risk controls remain robust under autonomous operations.

- Build organizational muscle across functions, enabling cross-team collaboration and learning.

- Cultivate trust with boards and regulators that agentic AI solutions can be deployed in a responsible and compliant manner.

However, pilots must never become the final destination. Without disciplined oversight, organizations risk pilot sprawl, with dozens of isolated implementations, inconsistent policies, and fragmented intelligence that never build into an enterprise-level capability.

Agentic-by-design: The destination

The long-term objective is an Agentic-by-design enterprise where autonomous agents are woven into the very fabric of operations rather than bolted onto existing workflows. In this future, organizations will:

- Deploy multiple agents collaborating fluidly across lending, payments, compliance, and customer service domains.

- Embrace continuous learning with built-in drift detection and adaptive policy adjustments embedded in daily operations.

- Codify controls, making auditability, explainability, and regulatory engagement seamless, integral components of the system, not afterthoughts.

- Achieve unparalleled organizational resilience, able to pivot rapidly in response to market shocks, regulatory shifts, and evolving customer demands.

This is where agentic AI ceases to be a project or a collection of pilots. It becomes the operating system of modern finance.

Bottom line: Strategy must match maturity. Start small but aim for Agentic-by-design as the destination.

Industrializing agentic AI delivery

Diagnosis without disciplined execution is strategy theatre. Once an institution has a clear view of its starting point, the real challenge begins: Turning isolated pilots into a production-grade, enterprise-wide Agentic AI capability without compromising trust, resilience, or compliance.

Industrialization is what separates experimentation from true transformation. It means turning AI from a collection of “projects” into an operating muscle: repeatable, governed, and scalable.

Selecting the first production-grade use case

Not every problem qualifies as a launch case. The right entry point combines:

- High-frequency, measurable decisions such as fraud triage, chargeback resolution, or exception handling.

- Material P&L impact balanced with manageable regulatory scrutiny.

- Clear ROI alignment with metrics the CFO and CRO already track.

The first use case sets the foundation for building trust with boards, regulators, and frontline teams while demonstrating tangible value.

The cross-functional delivery pod

Industrialized delivery demands cross-disciplinary squads, not siloed teams:

- Business Owner / SME: Frames the use case and defines KPIs

- Risk & Compliance: Establishes supervisory guardrails from day one

- Data & ML Engineers: Build, tune, and adapt agentic models continuously

- DevSecOps & SRE: Ensure secure, resilient deployment at scale

- Responsible AI Lead: Oversees fairness, explainability, and ethics

This structure ensures delivery is governed as rigorously as it is engineered.

Metrics that govern at scale

Generic “accuracy” doesn’t satisfy regulators or boards. Industrialized delivery requires domain-specific KPIs that provide clear insight into performance and risk:

- Decision Precision: Percentage of correct agent outcomes versus benchmarks

- Autonomy Ratio: Percentage of cases resolved autonomously without human intervention

- Learning Velocity: Time to adapt after drift detection

- Time-to-Decision: Latency measured in milliseconds or seconds where customer impact is direct

- Drift Score: Continuous monitoring of model degradation or deviation

Together, these metrics become the board’s lens for trust and the regulator’s lens for control.

The three-sprint industrialization path

A simple three-sprint path helps move safely from pilot to production:

- Sprint 1: Shadow Mode - Agent observes and simulates decisions without acting, validating performance safely.

- Sprint 2: Controlled Autonomy - Agent handles a limited volume of cases with human fallback and hard stops.

- Sprint 3: Scale Gate - Agent expands coverage only once KPIs and compliance thresholds are reliably met.

Each gate represents a binary decision: scale or retire. This cadence prevents pilot sprawl and enforces delivery discipline.

The run-state factory model

Industrialization doesn’t end at go-live. It institutionalizes a factory-like run-state that includes:

- Continuous Monitoring: Tracking latency, drift, override rates, and fairness.

- Rollback Protocols: Fast, auditable human takeover when thresholds are breached.

- Human-in-the-Loop Escalation: Dynamic guardrails overseeing critical decisions.

- Post-Release Learning Loops: Embedding feedback so each agent improves subsequent deployments.

Bottom line: Industrialization turns Agentic AI into an enterprise muscle. It relies on disciplined use case selection, cross-functional pods, decision-grade KPIs, gated scaling, and a factory model for resilience.

Trust at scale: Governing Agentic AI in finance

For BFSI, scaling Agentic AI is fundamentally a governance challenge rather than a purely technological exercise. Unlike traditional automation, autonomous agents make decisions that impact customers, markets, and regulators in real time. Without the right guardrails, the very capabilities that create value can quickly erode trust, invite regulatory scrutiny, and amplify systemic risk.

The institutions that succeed will not be those that scale the fastest, but those that govern the best.

Governance before growth

Too many pilots fail not because the technology is flawed, but because governance is treated as an afterthought. A scalable agentic AI model begins with policy-as-code. That means embedding compliance, risk, and ethical guardrails directly into the agent’s operating environment. This approach transforms oversight from an external, reactive function into an integral and proactive system capability.

The core governance pillars

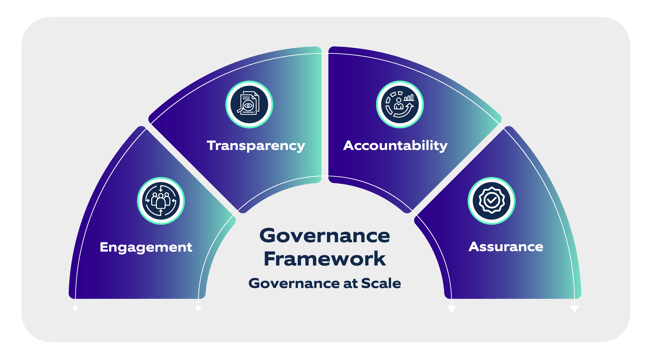

To satisfy boards, regulators, and customers alike, governance must operate across four foundational pillars:

- Transparency & Explainability: Every agent’s decision is logged, auditable, and explainable in clear business language.

- Human Accountability: Well-defined thresholds determine when decisions escalate to human review, ensuring humans retain ultimate accountability.

- Continuous Assurance: Run-state operations include ongoing independent validation, drift monitoring, and fairness testing.

- Regulatory Engagement: Proactive collaboration with supervisors, sharing audit trails and governance frameworks early to build confidence.

Figure 2 illustrates how these four pillars combine to form the structural foundation of governance at scale.

Figure 2: Governance Framework (Four Pillars)

Embedding risk appetite into autonomy

Just as boards approve credit or market risk limits, AI autonomy must have an explicit, quantitative risk appetite. For instance:

- Fraud decisions may operate at up to 80% autonomy within predefined false-positive limits.

- High-value lending decisions may require 100% human involvement (human-in-the-loop).

- Compliance alerts escalate automatically if thresholds are exceeded.

Setting these autonomy limits creates both a regulatory shield and an operational compass, defining what autonomy means in practical, controlled terms.

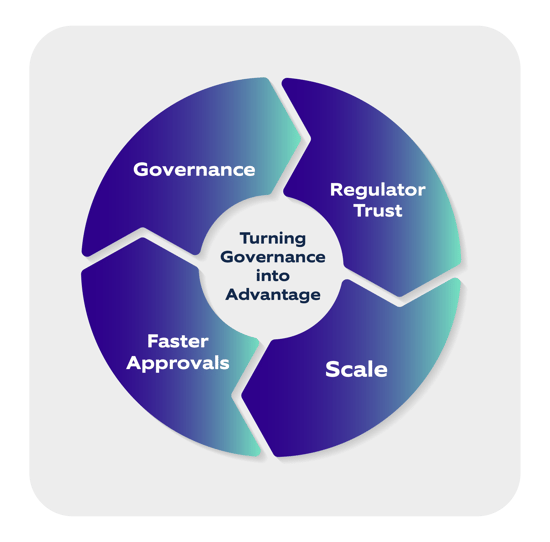

Turning governance into advantage

When governance is seen solely as cost or compliance burden, it slows AI adoption. However, when framed as a strategic asset, governance becomes an accelerator of innovation rather than a brake. Institutions with strong governance frameworks can:

- Deploy agentic AI in sensitive areas faster than competitors

- Earn regulator trust early, reducing approval delays

- Build customer confidence by making transparency and accountability differentiators

In essence, governance is a source of competitive advantage.

Governance can be a brake or an accelerator. Figure 3 shows how strong governance converts into competitive speed.

Figure 3: Governance as a virtuous cycle driving trust, approvals, and scale.

Bottom line: In finance, trust is the ultimate currency. Governance transforms AI from risk to advantage.

The agentic advantage: Redefining the future of BFSI

Banking’s history has always been shaped by technology, from the advent of ATMs to internet banking and now mobile-first experiences. Each wave redefined customer expectations, shifted competitive boundaries, and reshaped the role of financial institutions in society. Agentic AI is the next operating model. Institutions that successfully scale it will digitize their workflows, decide faster, adapt more fluidly, and grow smarter.

Where traditional automation focuses on efficiency, agentic AI is about intelligent autonomy: systems that execute instructions and also learn, adapt, and collaborate seamlessly across the enterprise. For BFSI leaders, this shift unlocks three horizons of advantage:

- Operational Resilience: Autonomous agents continuously monitor, detect, and adapt that minimizes fragility in payments, lending, and compliance ecosystems.

- Customer Intimacy: Hyper-personalized engagement that anticipates customer needs, rather than simply reacting to them.

- Strategic Agility: A decisioning platform enabling banks to pivot faster than regulators, markets, and competitors can anticipate.

The winners won’t be the institutions that adopt the technology fastest, but those that embed it deepest into their culture, governance frameworks, and operating models.

A leadership moment

Boards and CEOs now face a clear choice: continue cautious experimentation from the sidelines, or boldly build the agentic operating fabric that will define financial services for the next decade.

To act is to embrace complexity, but also to seize the power of compounding advantage. To wait is to jeopardize not only competitive positioning but institutional relevance itself.

The shift from pilot to production is an organizational transformation built around data flow, autonomous decision-making, and dependable governance. This is the heart of what Nagarro calls Fluidic Intelligence.

Fluidic Intelligence removes the barriers between people, data, and decisions. It is where:

- Engineering evolves through human–AI collaboration,

- Technology aligns through connected enterprise data and grounded models,

- And the enterprise adapts through friction-free intelligence flow.

For leadership teams, the opportunity is clear:

- Faster decision cycles through agentic workflows

- Around 20% uplift in productivity and speed by eliminating enterprise friction

- Stronger compliance and resilience with real-time policy-as-code

At Nagarro, we help banks and financial institutions unlock this potential by elevating them through Fluidic Intelligence and responsible Agentic AI engineering.

If you’re ready to move beyond pilots and build an enterprise where intelligence flows at scale, we can help identify your first production-grade use case.

Bottom line: The future of BFSI will not be shaped by AI agents alone. It will be driven by leaders with the courage to industrialize, govern, and scale agentic AI responsibly, transparently, and at pace.