In today’s tech-driven world, digital accounts and digital signatures have become catalysts for providing contactless digital financial services. Digital financial services will continue to be essential as we seek to achieve universal financial inclusion. In this blog, we will explore the importance of the bank account opening process for the economy.

A 2018 Oracle survey substantiated the fact that customers prefer digital channels for banking. According to the survey, 69% of the respondents want to operate their end-to-end financial lifecycle (account opening, loans, etc.) entirely through online and mobile channels.

Bank account – a “must-have” for financial inclusion

Broadly, financial inclusion is about making financial services available, accessible, and affordable to all (citizens and businesses) safely and transparently. Bank accounts are an important cog in assessing the outreach and efficacy of financial inclusion. To extend any financial service, the first and foremost step is to have a bank account. In many countries, for example in India, the government has launched programs like the Jan Dhan Yojna, which has proved to be a turning point in the country’s financial inclusion movement. Moreover, the growing economy is also creating new business, and these businesses also need bank accounts to manage their day-to-day operations.

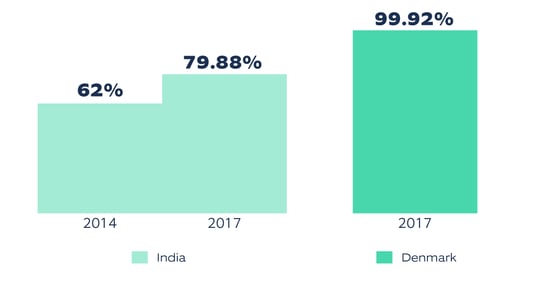

According to the data published by the World Bank in 2018, the percentage (%) of accounts opened at financial institutions (for the population aged 15+ years) for a country was highest for Denmark at 99.92%. For India, it was 79.88% (up from 62% in 2014).

Post-COVID-19

In the post-COVID world, social distancing norms will impact the business model of branch banking even more, and the banks will witness a surge in the number of customers acquired through digital channels. As per a McKinsey report, banks can play their part in reducing the spread of COVID-19 by helping customers perform the banking transactions via existing digital and remote channels (Do you know the latest Digital Lending trends in 2020? Click on the link to learn more). In fact, banks can convert this situation into an opportunity to push customers to go digital. However, for that to happen, they need to completely digitize their processes and one such important process is the account opening process.

Digital Account Opening (DAO)

The process for opening and onboarding a new account will achieve its goal only when an account can be opened without human interaction or without even entering the bank. For this, DAO must accomplish at least these steps digitally:

- Collect personal and business information along with the identity information during the application phase

- Scrutinize the applicants and business (for business accounts) from a KYC/compliance/AML/risk/fraud perspective and approve or reject the application

- Verify the identity of the applicant or business

- Collect funds digitally in real-time through different payment mechanisms

- Get a digital signature on the agreements

- Sync with the financial institution’s core banking system

- Give an omnichannel experience - provide the same level of services across all channels with data synchronization

Complexities in going fully digital

For each of the above steps in the DAO process, financial institutions can choose to either create capabilities on their own or collaborate with a technology partner and utilize their expertise. Out of all the steps, identity capture and verification process can be the most complex as they are time-consuming and costly.

The identity capture and verification solutions are in an evolving phase as they are adding capabilities to:

- do a liveness check

- test the authenticity of identity cards by analyzing every section of the ID card, etc.

- and finally, provide a seamless experience to the end customer

Moreover, if the verification process also involves a fraud check, it should tap into various government and third-party databases. It would be prudent for financial institutions to collaborate with technology partners(1) that are experienced with capabilities in doing identity verifications by using valid government IDs, biometrics, liveness checks, facial recognition, knowledge-based authentication, and other methods. Similarly, another step that generally needs human intervention is the digital signature step. Digital signature solutions(2) help perform this activity in a completely paperless and human-independent manner.

What is in store for banks?

Due to COVID-19, we are likely to see a decline in customer visits to bank branches. Banks can no longer view digital account opening and digital signatures as merely good-to-have features. They are now an imperative, must-have feature in the post-COVID world. Banks must take the necessary steps to provide this option to customers.

Moreover, the smart solutions around identity verification, digital signing, fraud and compliance checks can help the banks to perform the crucial KYC process and assess any associated risks. Digital account opening can help a bank compete with FinTechs and, at the same time, also adhere to the changing regulatory or compliance mandates.

Final thoughts

Digital account opening is one of the most important banking activities. Customers expect this activity to be quick, frictionless and secure, besides being an omnichannel experience. The objective of DAO is not just to improve customer experience by reducing the time taken, but to also reduce operating expenses and fraud, and expand the bank’s geographical outreach to tap into new customer segments.

The experience on mobile devices will be a key differentiator in capturing the new generations of tech-savvy customers. Banks can also try an iterative approach rather than a complete overhaul (which might be time-consuming). They can find out the drop-off points in their existing process and explore ways to improve those steps one-by-one. Further, it is also important to benchmark the improvements because the last thing a bank would want is to switch to an all-digital process resulting in the same rates of abandonment that it experienced with the traditional method.

If you want to accelerate customer acquisition, deliver an unmatched experience, and optimize costs through smart and intuitive, customized digital banking solutions, get in touch with us today!

(1) Some of the firms providing Identity verification capabilities are Idemia, Gemalto, Mitek, IDology

(2) Some of the firms providing Digital Signature capabilities are Docusign, Signow