Before we unravel ‘how’ banks can use APIs for integration, let’s begin by first understanding the ‘what’ and ‘why’: What do integrations do and why do we need APIs and API Management?

Banks and financial institutions are at the crux of a digital transformation era that mandates agility, efficiency, and innovation. In today's rapidly evolving banking landscape, integration has become a crucial element for financial institutions. Integrations streamline their operations, enhance customer experience, and drive innovation. However, integrating disparate systems, data sources, and technologies can pose significant challenges. This is where you can say hello to APIs!

Application Programming Interfaces (better known as APIs) have emerged as key enablers in offering a streamlined method for systems and applications to interact seamlessly. However, managing and leveraging APIs can also be a complex process fraught with challenges. To ease these challenges, API management platforms offer a comprehensive and robust solution. This article explores how banks can leverage WSO2's API management solution to resolve integration challenges and thrive in the digital landscape.

Understanding API Management in Banking

Let’s see how APIs and API Management can help in banking integration:

Role of APIs in Banking Integration

APIs play an instrumental role in banking integration by enabling disparate systems to communicate and share data. However, simply developing APIs is not enough; they must also be managed effectively to unlock their full potential. APIs serve as bridges that enable different software systems to communicate and share data, empowering banks to offer diverse services and streamline internal processes. They play a vital role in enabling mobile banking, payment processing, data sharing, and seamless customer experiences. They also facilitate collaborations with third-party providers, fintech startups, and other financial institutions, fostering an open and interconnected banking ecosystem.

Importance of API Management

While APIs offer immense value, effective management is key to ensuring their success, this is where API management comes into play. API management is the process that involves designing, creating, publishing, securing, monitoring, and analyzing APIs in a secure and scalable environment. It's a comprehensive set of practices that allows banks to control and analyze the APIs that connect applications and data across their enterprise and beyond. API management helps banks to manage the complete API lifecycle, facilitate seamless integration, ensure security, and gain meaningful insights through analytics. Banks must adopt an API management platform, which provides a suite of tools that helps manage APIs effectively. These platforms help create a secure channel for data exchange, manage API traffic, enforce policies, provide detailed analytics, and promote developer engagement.

Addressing Integration Challenges in Banking with API Management

Integration challenges in banking core systems refer to the difficulties and obstacles encountered when integrating different components or modules within a bank's core banking system. These challenges can come up due to various factors, including technical limitations, legacy systems, and complex business processes. Here are some common integration challenges in core banking systems:

1. Legacy Systems

One of the most common integration challenges in banking is the presence of legacy systems. Many banks still rely on outdated infrastructure that hampers their ability to integrate new applications or services seamlessly. Typically, these systems lack modern interfaces and standard protocols, making it difficult to connect them with newer technologies or third-party applications. Legacy system integration requires careful planning, modernization strategies, and the use of middleware or API solutions to bridge the gap between old and new systems.

To overcome these challenges, banks must undertake a comprehensive modernization effort. This involves replacing the legacy systems with agile and scalable technologies that support open APIs and cloud-native architecture. By leveraging modern solutions, banks can unlock the full potential of their data, foster collaboration across departments, and enable seamless integration with external partners. API management provides a solution by enabling the creation of APIs that act as intermediaries, allowing legacy systems to interact seamlessly with newer applications. Additionally, API management platforms facilitate data integration by exposing data from various sources through standardized APIs and enhancing accessibility.

2. Siloed Data

Core banking systems generate and store massive amounts of data across multiple modules and databases. Siloed data, scattered across multiple systems, creates inefficiencies, and inhibits real-time decision-making. Integrating and consolidating this data can be a significant challenge, especially when dealing with inconsistencies, duplication, or data quality issues.

Implementing robust data integration frameworks, employing data governance practices, and ensuring data integrity are crucial to achieve a unified and reliable view of the customer and the transaction data. API management allows banks to 'wrap' legacy systems with APIs, enabling them to interact with modern, cloud-native applications. This breaks down data silos and enhances the interoperability between different systems, resulting in improved operational efficiency and data-driven decision making.

3. Data Security and Compliance

Data security and compliance are two crucial cogs in banking. Integration in banking must adhere to stringent compliance and security regulations, such as data privacy laws (e.g., GDPR) and industry standards (e.g., PCI DSS). Integrating systems without considering these requirements can expose banks to significant risks, including data breaches and regulatory penalties. APIs expose backend data and services for use by applications. If they are not managed and secured properly, they can pose significant security risks.

Integrating core systems while adhering to various regulations, such as Anti-Money Laundering (AML) and Know Your Customer (KYC), can be challenging. To address compliance and security challenges, banks should adopt a proactive approach. They must establish a robust governance framework, implement encryption and tokenization techniques, and conduct regular security audits. API management platforms provide robust security protocols, including OAuth, JWT, and SAML. These platforms also provide detailed access control, allowing banks to determine who can access what data, thus helping banks comply with stringent data privacy regulations.

4. Data Quality and Standardization

Integrating diverse data sources with varying formats, structures, and quality levels can lead to significant data inconsistencies and inaccuracies. Poor data quality not only affects decision-making but also hinders customer service and operational efficiency.

To overcome data-related challenges, banks need to prioritize data quality and standardization. This involves implementing data governance practices, such as data cleansing, normalization, and validation. Additionally, leveraging data integration platforms that provide data profiling, cleansing, and enrichment capabilities can help ensure the accuracy and consistency of integrated data.

5. Partner Ecosystem Integration

As banks collaborate increasingly with fintech startups, technology vendors, and other financial institutions, it is even more crucial to integrate their partner ecosystems. However, integrating diverse systems, each with its own protocols and APIs, can present significant complexities.

To successfully integrate a partner ecosystem, banks should establish clear integration standards and guidelines. By defining common APIs and using industry-standard protocols like REST or SOAP, banks can streamline integration efforts and facilitate seamless communication with partners. Collaborating with partners early in the integration process, conducting thorough testing, and fostering open communication channels also contribute to smoother integration.

6. Change Management and Cultural Shift

Introducing changes or updates to core systems can be disruptive to day-to-day banking operations. Managing change and minimizing the impact on business processes and customer experience is crucial. Banks should develop effective change management strategies, including comprehensive testing, user training, and phased implementation plans. This will lead to a smooth transition for the bank and will minimize disruption.

In order to overcome these challenges, banks must invest in comprehensive change management strategies. This includes effective communication about the benefits of integration, providing training programs to equip employees with the necessary skills, and fostering a culture of adaptability and continuous learning. Encouraging cross-functional collaboration and involving employees in the integration process can also help mitigate resistance and ensure a smoother transition.

Leveraging WSO2 for Effective API Lifecycle Management and Data Integration

WSO2, a leading open-source technology provider, offers a powerful API management platform, known for its agility, flexibility, and scalability. The WSO2 API Manager allows banks to create, manage, and monitor APIs while ensuring security and regulatory compliance. This comprehensive platform provides several key features, including API designing, gateway, key and traffic management, policy enforcement, analytics, and more.

WSO2 API Manager is a comprehensive platform to build, integrate, and expose your digital services as managed APIs in the cloud, on-premise, and across hybrid architectures to lead your digital transformation strategy. It allows API developers to design, publish, and manage the lifecycle of APIs and API product managers to create API products from one or more APIs.

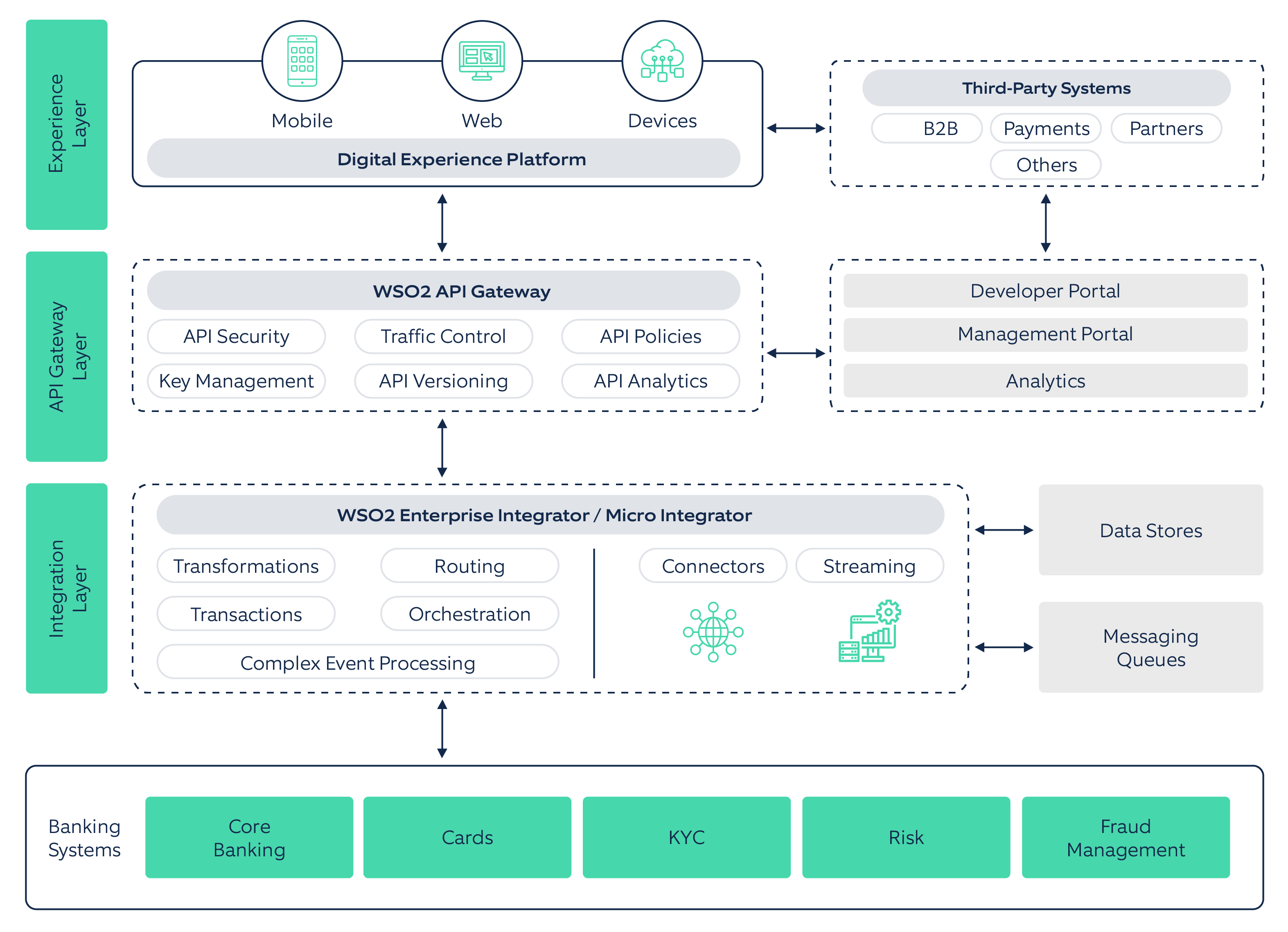

Here is the reference framework for banking integration, based on WSO2 API Management solution:

How can you benefit from WSO2 APIM capabilities?

Enable design and runtime governance for the complete lifecycle of your APIs: You can create APIs from existing services, manage APIs from internally-built applications and from third-party providers. You can even monitor their usage and performance from inception to retirement.

Easily and securely expose the APIs to internal as well as external customers: You can easily implement industry-standard authorization flows (like OAuth, OpenID Connect, and JWTs) out of the box and can then integrate them with your existing identity access or key management tools.

Advanced integration support: The integration runtime allows you to create composite service and API hosting needs, message routing, transformation, message mediation, service orchestration, as well as consume and process streaming data.

Flexible deployment models: You can deploy WSO2 in the cloud, your private data centers, or anywhere in between. By cataloguing your services in a single location, developers can easily find what they need to build their applications. You can also embed WSO2 API Manager within your own SaaS or on-premises solution for redistribution.

Conclusion

While integration challenges in banking can be complex, they can be overcome successfully by deploying the right strategies and approaches. By embracing modern technologies like WSO2, ensuring compliance and security, prioritizing data quality, fostering collaboration with partners, and managing change effectively, banks can unlock the full potential of integration. Embracing integration not only enhances operational efficiency but also enables banks to deliver superior customer experiences, drive innovation, and stay competitive in this rapidly evolving financial landscape.

Check out this success story where we solved the integration challenges for one of our clients.